Income Tax Act 1967 (Act 53)

An Act for the imposition of income tax.

Contains:

Income Tax Act 1967 (Act 53)

Income Tax (Qualifying Building Annual Allowances) Rules 1986

Income Tax (Deduction from Remuneration) Rules 1994

Income Tax (Qualifying Plant Allowances) (Computers and Information Technology Equipment) Rules 1998

Income Tax (Allowance for Increased Exports) Rules 1999

Income Tax (Deductions for Promotion of Export of Services) Rules 1999

Income Tax (Qualifying Plant Allowances) (Cost of Provision of Computer Software) Rules 1999

Income Tax (Deduction for Information Technology-Related Expenditure) Rules 2000

Income Tax (Accelerated Capital Allowances) (Recycling of Wastes) Rules 2000

Income Tax (Deductions for Promotion of Export of Higher Education) Rules 2001

Income Tax (Deduction for Corporate Debt Restructuring Expenditure) Rules 2001

Income Tax (Approved Agricultural Projects) Order 2002

Income Tax (Deduction for Cost of Acquisition of Proprietary Rights) Rules 2002

Income Tax (Transfer Pricing) Rules 2012

Income Tax (Advance Pricing Arrangement) Rules 2012

Income Tax (Determination of Approved Individual and Specified Year of Assessment under the Returning Expert Programme) Rules 2012

Income Tax (Industrial Building Allowance) (Child Care Centre) Rules 2013

Income Tax (Deduction for the Provision of Child Care Centre) Rules 2013

Income Tax (Deduction for Consultation and Training Costs for the Implementation of Flexible Work Arrangements) Rules 2015

Income Tax (Set-Off for Tax Charged on Actuarial Surplus under Takaful Business) Rules 2017

Income Tax (Accelerated Capital Allowance) (Information and Communication Technology Equipment) Rules 2018

Income Tax (Requirements for Insurer Carrying on Re-Insurance Business) Rules 2018

Income Tax (Requirements for Takaful Operator Carrying on Re-Takaful Business) Rules 2018

Income Tax (Deduction for Expenses in Relation to Secretarial Fee and Tax Filing Fee) Rules 2020

Income Tax (Special Treatment for Interest on Loan) Regulations 2020

Income Tax (Deduction for Value of Benefit Given to Employees) Rules 2021

Income Tax (Accelerated Capital Allowance) (Machinery and Equipment Including Information and Communication

Technology Equipment) Rules 2021

Income Tax (Deduction for Expenses in Relation to the Cost of Personal Protective Equipment) Rules 2021

Income Tax (Deduction for the Cost of Implementation of Flexible Work Arrangements) Rules 2021

Income Tax (Deduction for Expenses in Relation to the Cost of Detection Test of Coronavirus Disease 2019 (COVID-19)

for Employees) Rules 2021

Income Tax (Exchange of Information) Rules 2021

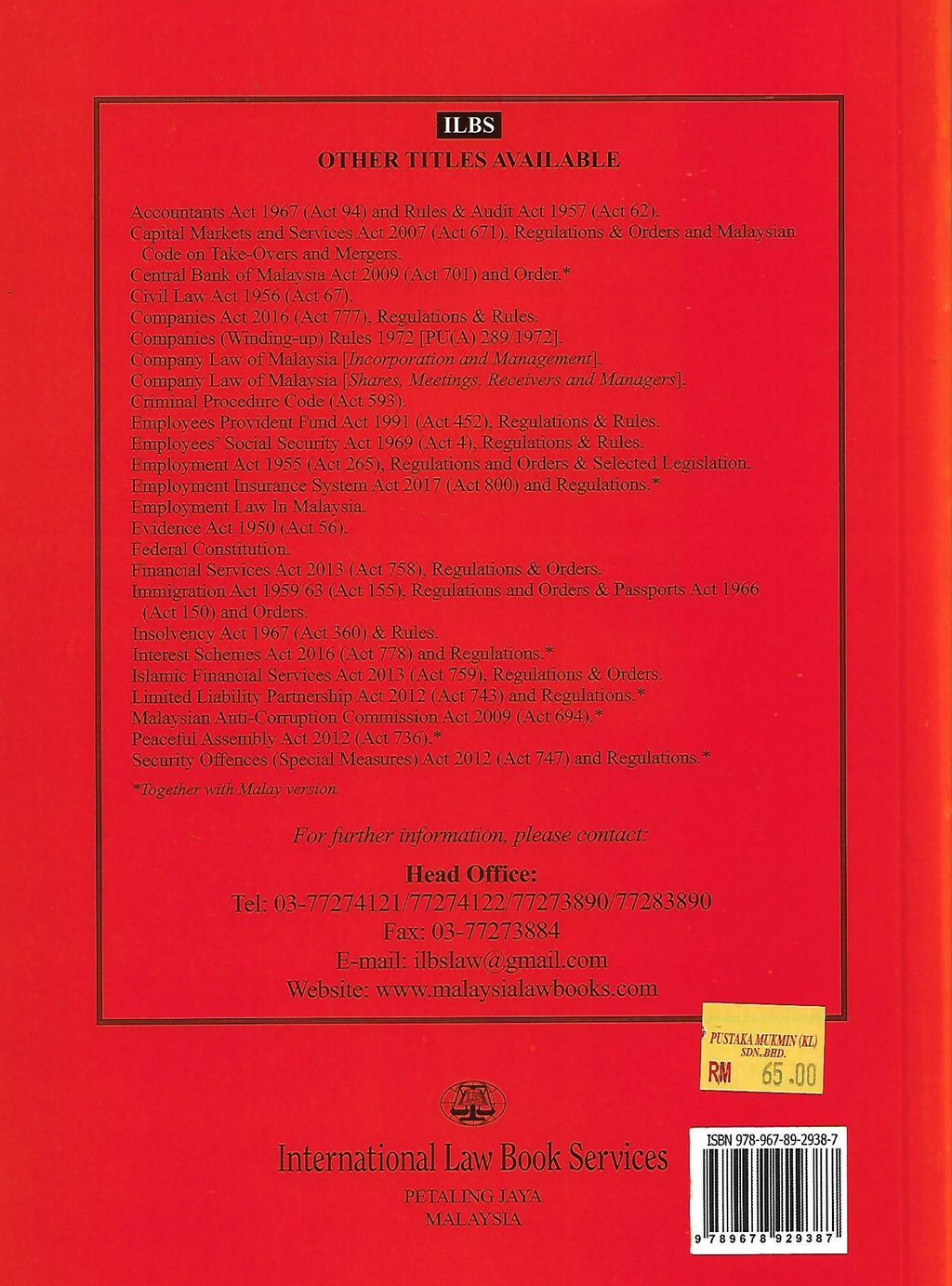

Please refer to the images for a summary/synopsis of the book.

Sila rujuk kepada gambar halaman belakang buku untuk membaca ringkasan buku tersebut.

Customer comments

| Author/Date | Rating | Comment |

|---|